In our everyday exchanges, the idea of a "bill" is, you know, something we come across all the time. It's not just a piece of paper or a digital notice; it actually represents a promise, a record, or sometimes, a real challenge. From the moment a service is rendered or an item is purchased, the journey of a bill begins, winding its way through different systems and, frankly, different hands. It's a pretty fundamental part of how we keep things going, whether we are talking about a small household or a really big company.

This whole process, too it's almost like a quiet engine that keeps so much of our world moving. We see bills for our regular subscriptions, for things we pick up at the store, or for services that help us out around the house. For businesses, the story gets a bit more involved, with lots of pieces moving together. They're managing incoming charges from suppliers and, in a way, also sending out their own requests for payment. It's a constant back-and-forth, a kind of financial conversation that, quite often, needs to be handled with care and accuracy.

Sometimes, though, the world of bills can feel a little, well, overwhelming. There are times when a bill might seem a bit, shall we say, "gross" in the sense of being a total amount that feels large, or perhaps even a bit unpleasant if it's unexpected or wrong. This discussion will look at the many sides of bills, from how businesses handle them to those surprising moments when a charge pops up that you just don't recognize. We'll explore what it means to truly manage these financial pieces and, you know, how we can make the whole experience feel a little less, well, complicated.

Table of Contents

- The Core of Financial Bills: What is the Big Deal?

- Streamlining Your Bill Gross Process: How Can Technology Help?

- Beyond the Numbers: Are All Bills Gross?

- Connecting the Dots: What Does 'Bill' Really Mean?

- Managing Your Bill Gross Situation: Where to Find Support?

- The Larger Economic Bill: What About Business Growth?

- A Different Kind of Bill: Who is Bill Skarsgård?

- A Recap of Our Discussion

The Core of Financial Bills: What is the Big Deal?

When we think about a business, a really important part of its daily life involves handling money that goes out. This is often called the "accounts payable" or AP process. It's a series of steps that starts when a business gets something, like a delivery of goods or a service, and then receives a request for payment. So, that means getting the bill itself, making sure it's accurate, getting the right people to say it's okay, and then, you know, actually sending out the money. It's a pretty involved cycle, and if it's not handled well, things can get a little messy, perhaps even causing some financial discomfort.

This whole sequence, from the very first moment a charge is made to the final payment leaving the bank account, can be, well, quite a bit of work. It involves making sure every single detail on the bill is correct, that it matches what was ordered, and that all the right approvals are gathered. For a business, getting this part right is, like, absolutely vital for keeping good relationships with suppliers and for making sure money is flowing in the right direction at the right time. It's not just about paying; it's about paying correctly and on schedule, which, you know, helps everything run a lot more smoothly.

One of the big goals for businesses, when they look at their financial operations, is to make this entire AP process, from the initial bill creation to getting those approvals and then making the payments, feel much less cumbersome. They want to make it simpler, more straightforward, and, in a way, less prone to mistakes. This kind of improvement helps them keep a better eye on their money. It's about being able to see exactly what's coming in and what's going out, which, you know, is pretty important for making smart choices about spending and saving. It's all part of managing that larger "bill gross" picture, ensuring the overall financial health stays strong.

Streamlining Your Bill Gross Process: How Can Technology Help?

Imagine trying to keep track of every single paper bill, every approval signature, and every payment by hand. It would be, well, a pretty huge task, especially for a business that handles a lot of transactions. This is where technology steps in to offer a helping hand. Systems that can automate the accounts payable process are, in some respects, a real boon for businesses looking to manage their financial obligations more effectively. They help to make the process of paying business invoices online much simpler, which, you know, saves a lot of time and reduces the chances of errors.

These modern tools can easily connect with a business's existing accounting software. This connection means that information about bills, payments, and expenses flows seamlessly between different parts of the financial system. There's no need for manual data entry in multiple places, which, as a matter of fact, can be a source of many headaches. This kind of integration helps to create a complete and accurate picture of a company's finances, allowing them to keep a much better tab on their money. It’s about making sure that every part of the "bill gross" journey is accounted for, from start to finish.

Beyond just making payments easier, these systems also offer something really important: better control over cash flow. They give businesses the ability to manage their credit and oversee their spending in a way that helps them optimize how money moves through their operations. This means they can make sure they have enough money available when they need it, and that they're not overspending in areas where they don't need to. It's about having the right information and the right tools to make smart financial decisions, which, quite honestly, can make a huge difference in how a business performs. Millions of businesses and accounting firms, apparently, already put their trust in these kinds of systems.

Beyond the Numbers: Are All Bills Gross?

Sometimes, a bill isn't just about a service or a product received; it can also be something unexpected, something that, frankly, feels a little out of place. We've all heard stories, or perhaps even experienced it ourselves, where a charge appears that you just don't remember authorizing. For example, you might get a message saying "Thanks for your order on November 20, 2024," when you, you know, didn't order anything at all. This kind of situation can be pretty unsettling, making you wonder, "Is it a scam?" It's a moment when a "bill gross" feeling, meaning a feeling of something being wrong or unpleasant, really sets in.

These unexpected charges can come in many forms. It could be something like a "driver support bill" that you thought was a one-time thing, but then you find yourself charged twice. Or, it might be a bill for a "copilot" service that you don't recall signing up for. In these moments, your first thought is often, "How can I cancel this?" or "How can I contact the source?" It's a natural reaction when you feel like you're being asked to pay for something that isn't quite right. The feeling of being charged for something you didn't ask for can be, well, a bit frustrating, to say the least.

The text mentions "harassment" as any behavior meant to upset someone, and "threats" as any threat of violence or harm. While a rogue bill might not be a direct threat of violence, the feeling of being unfairly charged, or repeatedly charged, can certainly feel like a form of financial harassment. It's about feeling disturbed and upset by something that seems out of your control. This highlights a really important side of managing bills: it's not just about paying the ones you expect, but also about knowing how to deal with the ones that feel wrong or, you know, just plain "gross."

Connecting the Dots: What Does 'Bill' Really Mean?

The word "bill" can mean a few different things, and it's interesting to see how many ways it pops up in our daily conversations and systems. Most often, we think of it as a request for money owed, like when you need to pay your bill for a Microsoft 365 subscription. That's a pretty straightforward use, where you sign in to your account and follow the steps to make the payment. This kind of "bill" is a clear financial obligation, something you expect and plan for. It's a common part of managing your personal or business finances, and, you know, typically doesn't cause too much surprise.

But "bill" can also refer to a specific platform or service that helps you manage these financial transactions. For instance, the text mentions "Bill" as a trusted platform that millions of businesses and accounting firms rely on. This "Bill" is a system that simplifies the entire process for small businesses, offering digital invoices and electronic payments. It's a tool that helps automate payments, manage expenses, and, as a matter of fact, improve cash flow all from one central place. So, in this context, "Bill" isn't just a document; it's a whole solution designed to make financial operations smoother, which, you know, is quite useful.

Then there's the idea of a "bill" as a piece of proposed legislation, like a "bill" that restores 100% immediate expensing. This kind of "bill" is about economic policy, something that can empower businesses, especially those on "main street," to expand, hire more people, and even raise wages. It's a very different kind of "bill" from a payment request, but it still has a significant impact on financial well-being, just on a much larger scale. It shows how the word "bill" can apply to, like, really different aspects of our financial and economic lives, from the smallest transaction to, you know, big government decisions.

Managing Your Bill Gross Situation: Where to Find Support?

When you run into a problem with a bill, especially one that feels wrong or confusing, knowing where to get help is, well, pretty important. The text points out that if your spend and expense account is connected with other "Bill" products, like their accounts payable and receivables systems, you need to go through the main "Bill login page." This suggests a centralized way to access all your financial tools and, you know, get a clear overview of your accounts. It's about making sure you're in the right place to begin sorting things out.

For those moments when you need a little assistance with your account, visiting the "Bill help center" is, apparently, the place to go for live support. They offer information on support hours and give you the option to chat with an agent. This kind of direct help is, you know, really valuable when you're trying to figure out a confusing charge or a payment issue. It's about having someone to talk to who can guide you through the steps, which, quite honestly, can make a big difference when you're feeling a bit stuck.

Sometimes, the help you need isn't from a dedicated "Bill" platform, but from the source of the bill itself. If you're dealing with a Microsoft 365 subscription bill, for instance, you'd typically sign in to your Microsoft account to handle it. And if you're trying to clear up an issue with a bank, a representative might even walk you through things like clearing caches and cookies, which, you know, can sometimes resolve access problems. It's all about finding the right channel for support, whether it's for a "bill gross" amount or just a simple query, to ensure you get the clarity you need.

The Larger Economic Bill: What About Business Growth?

Beyond the individual transactions and the specific bills we pay or receive, there's a broader idea of a "bill" that affects the economy as a whole. This is often in the form of legislation or policy changes that can, in a way, shape how businesses operate and grow. The text mentions a "bill" that "restores 100% immediate expensing," which is a pretty significant concept for companies. This means businesses could, you know, write off the full cost of their investments, their expansion efforts, and any modernization they undertake, right away.

This kind of policy is designed to give businesses, particularly those smaller operations often called "main street" businesses, a real boost. It's about giving them the financial flexibility to do more. When they can immediately deduct the full cost of new equipment or facility upgrades, it makes it easier for them to decide to invest. This, in turn, can empower them to expand their operations, which often means they can hire more people. More hiring, in some respects, can lead to raising wages for their employees, which, you know, benefits everyone.

So, while we often think of a "bill" as something we have to pay, this example shows how a "bill" can also be a tool for economic development. It's a way to encourage growth and create more opportunities. It highlights how the concept of a "bill," whether it's a small invoice or a major piece of legislation, is actually deeply connected to the overall financial health and future possibilities of, you know, not just individual companies, but entire communities. It's a big picture "bill gross" consideration that impacts many lives.

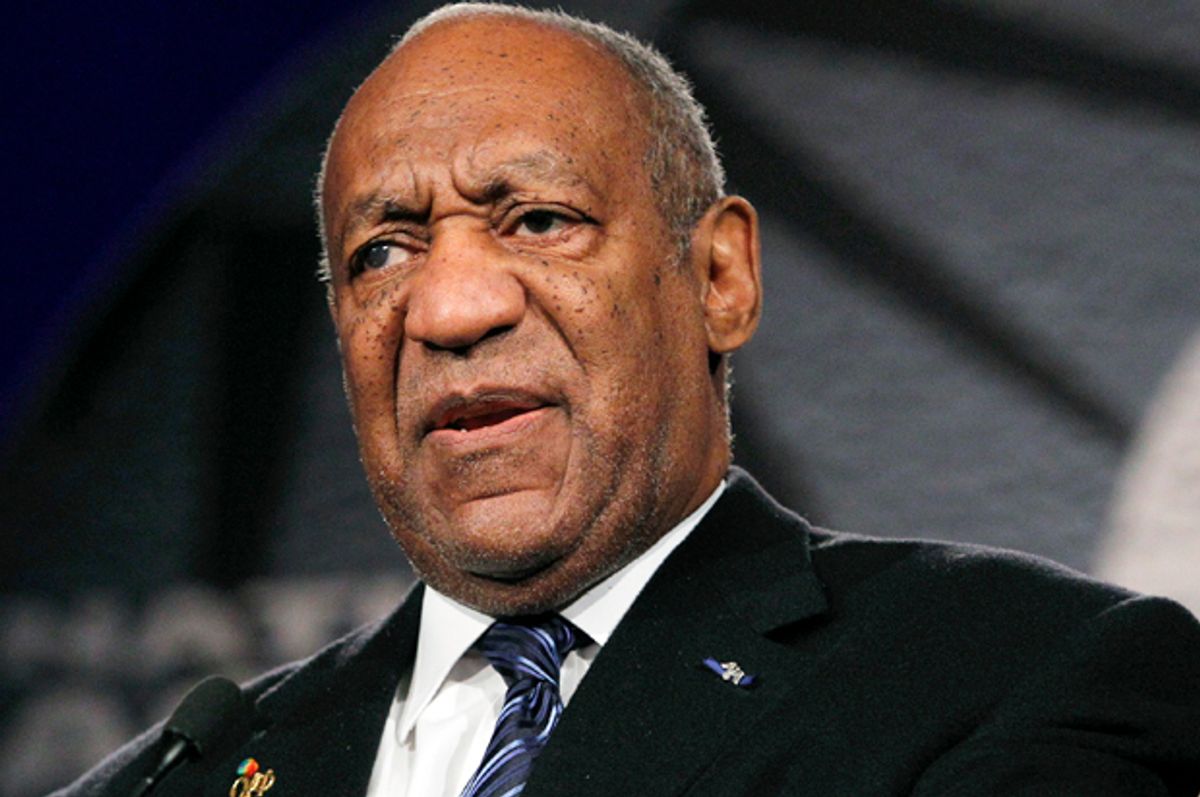

A Different Kind of Bill: Who is Bill Skarsgård?

In a slightly different turn from the financial discussions, the word "Bill" also comes up in the text in reference to a person: "Bill Istvan Gunther Skarsgard." This "Bill" is a Swedish actor, and, you know, he's also involved in producing, directing, writing, voice acting, and even modeling. It's a pretty diverse set of talents for one individual. This particular "Bill" is, apparently, most recognized for his portrayal of Pennywise the Dancing Clown in certain well-known films.

This mention of Bill Skarsgård serves as a reminder that the word "bill" isn't always about money or financial transactions. Sometimes, it's just a name, a label for a person who has their own story and their own contributions to the world, in this case, the world of entertainment. It shows how a single word can have, like, really varied meanings depending on the context. It's a nice little detour from the usual "bill gross" talk about payments and invoices, reminding us of the richness of language.

So, while much of our conversation has centered on the practicalities of financial bills, it's interesting to note how the same word can point to something completely different. It's a bit like how a single note in music can be part of many different melodies. This "Bill" is a creative individual, known for bringing characters to life, which is, you know, a very different kind of contribution than managing a company's accounts payable. It just goes to show how many different meanings a simple word can carry.

A Recap of Our Discussion

We've explored the many sides of what a "bill" can mean, from the everyday financial requests we receive to the sophisticated systems businesses use to manage their money. We looked at how automating accounts payable processes can really help companies streamline their operations, making bill creation, approvals, and payments much smoother. We also touched upon the importance of optimizing cash flow and having good control over spending, which, you know, is vital for any business.

Our conversation also covered those moments when a bill might feel a bit "gross," perhaps because it's an unexpected charge or even a potential scam. We discussed the need to know where to find support in such situations, whether it's through a dedicated help center or by contacting the source directly. Furthermore, we considered the broader economic impact of legislative "bills," like those that encourage business investment and growth, showing how these large-scale policies can empower companies to expand and create jobs.

Finally, we took a moment to acknowledge how the word "bill" can also refer to a person, specifically mentioning Bill Skarsgård, the actor. This highlighted the diverse meanings a single word can hold, depending on the context. Overall, it's clear that the concept of a "bill," in its various forms, is a pretty fundamental part of our financial and even our cultural landscape.